Causing Inflation Is What The Fed Does Best

Inflation as I think about it means growth in the money supply. Grow the money supply and the currency unit (the USD), by definition is devalued. Much like issuing new equity dilutes the value of shares in existence.

My definition of inflation used to be the Fed’s definition until after the inflationary period of the late 1970s-early 1980s, which is when the Fed sought to deflect responsibility and changed the definition to mean increases in the price of goods and services, which of course is a function of a devalued currency.

The Fed grows the money supply to support economic growth (our fractional reserve banking system), and to intervene in the economy by way of open market operations and various initiatives (QE, QT, BTFP, various credit facilities), that by their very nature are the epitome of arrogance. For a central bank to think it may tame an economy is a fool’s errand, much like man can not conquer nature.

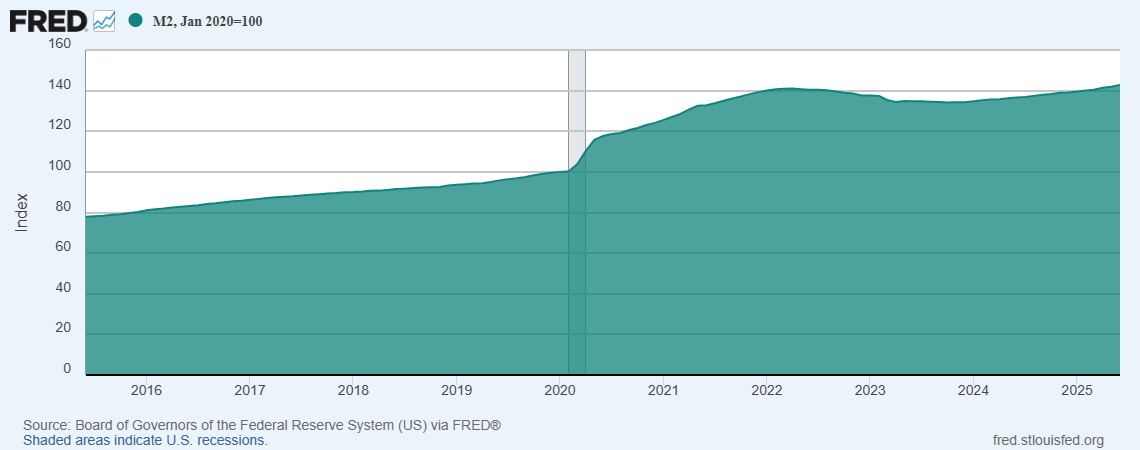

“But the Fed deftly maneuvered through the COVID period to guide the economy without much disruption” you may say. Not true. Look at the M2 chart below (M2 indexed at 100 in January 2020). The Fed grew the money supply by 40% from January 2020 through April 2022. How is that a win? That chart is your true inflation calculation. Today’s sky high housing prices, ever increasing food prices and elevated energy prices are a function of ultra-expansionary, interventionist Monetary Policy.

The Fed didn’t need to pump $90 Billion into the Treasury market each month because a bad flu strain swept the country in 2020. The Fed did not need to pump $30 Billion into the mortgage market each month over the same period (April 2020 - May 2022). It did not need to participate in AAPL’s debt deal, it did not need to buy equities through Larry Fink’s ETFs (illegal per the Fed’s 1913 charter). The Fed doubled its balance sheet from January 2020 - April 2022.

We are still feeling the effects of the Fed’s actions (fiscal policy as well), and will be saddled with this mess for decades to come absent fiscal austerity augmented by relegating the Fed to the sidelines.

Instead, this Fed is positioning to lower rates. I would argue the Fed never achieved a restrictive monetary policy in 2022 through today as the Fed never took rates high enough, nor did it sufficiently shrink the money supply.

If you would like to read my Amazon book that I wrote back in April 2021 when nobody wanted to hear the bad news, you may find it on Amazon HERE.