Federal Reserve Weekly SOMA Update

The Fed held its balance sheet steady for the second consecutive week. At the end of the day, the Fed’s balance sheet actions carry for more sway over the U.S. economy than its arbitrary Fed Funds decisions. The Fed used to run its balance sheet at approximately $1 Trillion until the 2008 bailouts, at which time the Fed grew its balance sheet to $4.5 Trillion over 6 years. The COVID period of 2020-2022 was unique in the level of fiscal and monetary subsidy of the U.S. economy, during which time Powell’s Fed in its fever dream took its balance sheet from $4 Trillion in February 2020 to $9 Trillion in April 2022. The Fed’s modest QT effort has culled $2.3 Trillion from its balance sheet since May 2022. It would be prudent to cull another $2 Trillion in my view, but that culling will only happen in my dream of fiscal austerity.

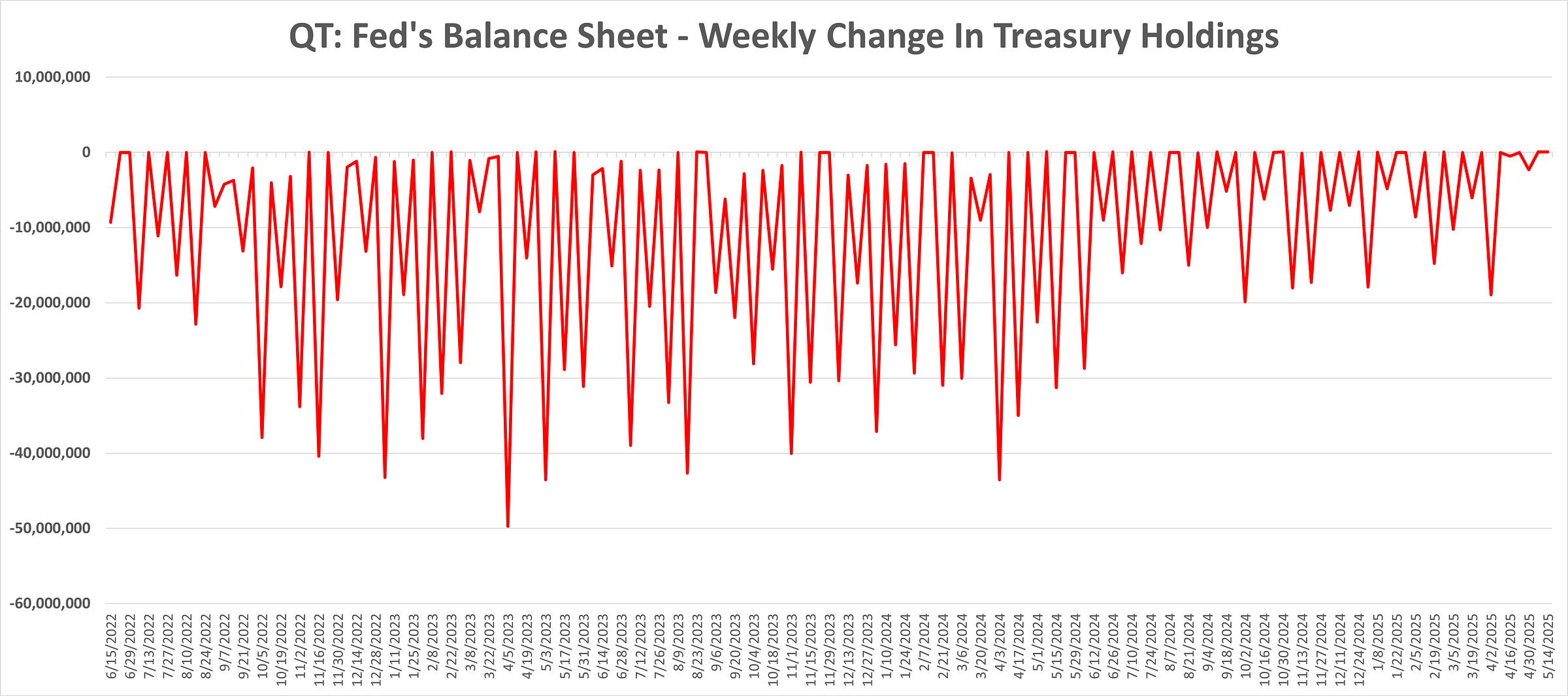

Treasuries: The Fed’s Treasury holdings increased by $75 million for the week-ended May 14th (the second consecutive week of modest Treasury growth). The Fed’s Treasury holdings declined by $2.2 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings were unchanged for the week-ended May 14th (the second consecutive week of no activity). The Fed’s Government Agency holdings declined by $15.9 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.