From AI Agents & Slop to The Fed & Easy Credit

We OpenSourced Monday’s report on OpenSource AI agents: HERE

AI picking up economic slack? That’s news to me! I keep hearing that “AI” is offsetting economic slowness. By what measure? Data center construction? Who cares about data center construction. What’s data center utilization as it relates to Gen AI - a bunch of kids (and adults) producing AI-generated slop? That’s not productivity. AI writing quality code faster is a good ROI. AI-document summary is a good ROI. However, my fear is that 90% of Gen AI tokens are being used in a non-productive manner.

How will we recognize “AGI” or “Super Intelligence?” These are marketing terms designed to promote LLM company valuations. When AI tools create new advanced mathematic principles and discover new drugs - that will be advanced intelligence. My sense is that LLMs, given their architecture and linear learning pattern, will not get us there. “Superintelligence” may be 50-100 years away. It is definitely not “around the corner”.

T2D Pulse - more content: We’ve added more content sources to T2D Pulse over the past several days (FinTech and AI in particular), along with trend analysis: HERE

Source: T2D Pulse Israel cease fire: I hate to say “I told you so”, but it was easy to call Israel breaking the ceasefire.

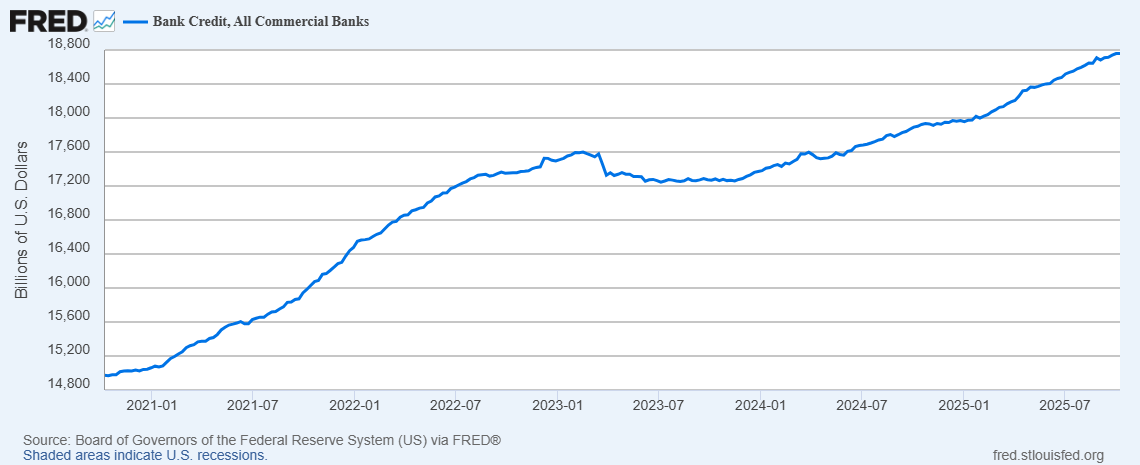

Fed Easing: If the Fed continues to ease, price inflation is likely to persist. The 10-Year Treasury yield may very well move higher as Treasury investors do the math on the United States’ poor fiscal situation and the ever depreciating Dollar.

Source: Fed Funds vs. M1, Fred Easy Credit: I am not looking forward to another era of easy credit led by zero reserve requirement fractional reserve banking and a 0-1% Fed Funds Rate. Private Equity firms acquiring companies only to cut headcount and not grow the top line is a poor use of capital. CEOs buying back stock only to bolster option packages while ignoring product investment is not a good use of capital.

Not cut from the same cloth. As Thanksgiving approaches I am reminded of John Smith and Myles Standish - settlers and true, productive capitalists - both of whom would have mopped the floor with this crew of modern-day financiers and CEOs.